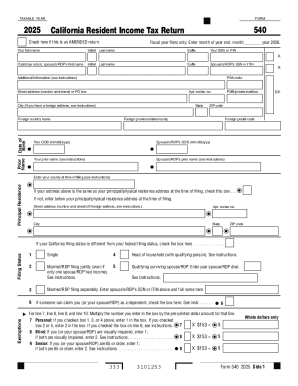

Who needs a FT 3567 form?

This form is used by individuals who can’t pay their taxes in full. The installment agreement lets them make monthly payments to comply with their tax obligations.

What is the FT 3567 form for?

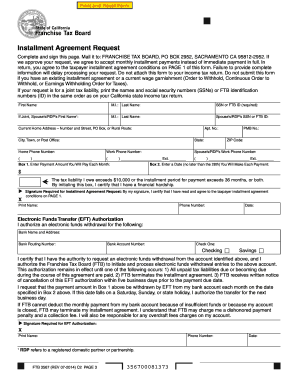

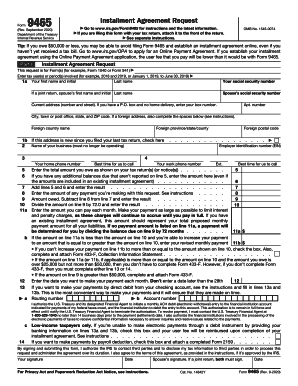

This form is a request for an installment agreement. If approved, the taxpayers should pay the required taxes' month by month. First, however, they have to determine whether they are eligible for completing the request. The main eligibility conditions are: the tax liability doesn’t exceed $25,000; the installment period does not exceed 60 months; all the required tax returns are filed; and there is no other installment agreement. The information provided in the form is used by the Franchise Tax Board to make a decision on a taxpayer’s case and to approve or reject the request.

What documents must accompany the FT 3567 form?

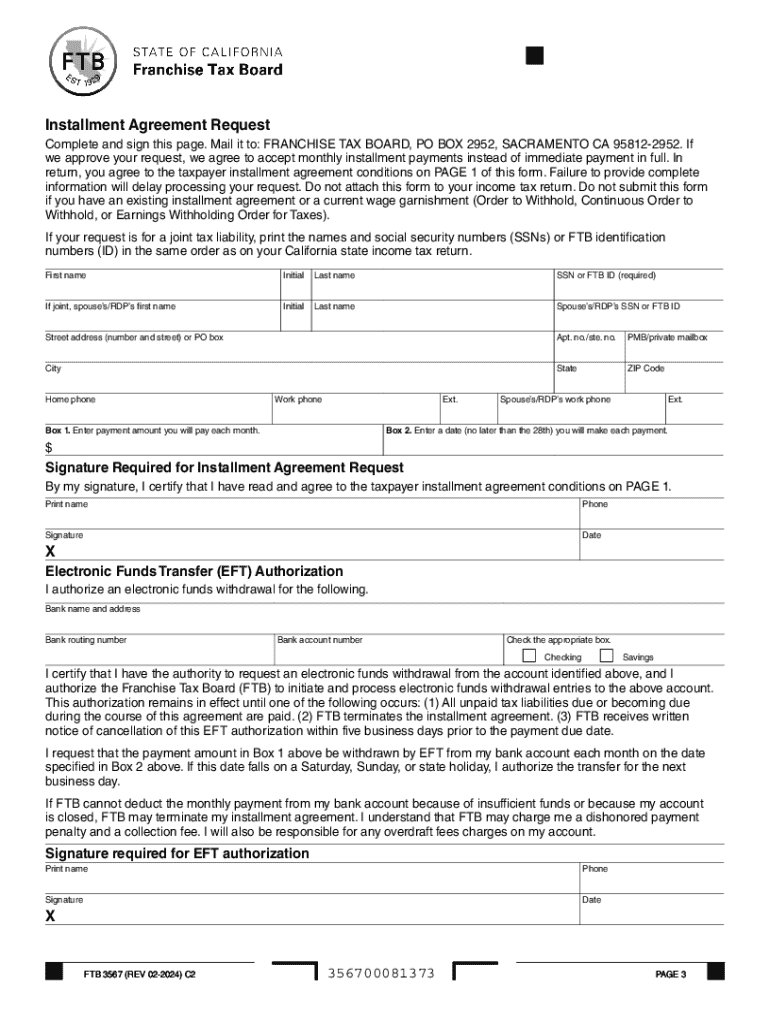

The Installment Agreement Request should be submitted together with the Electronic Funds Transfer Authorization on page 3 of the form.

When is the FT 3567 form due?

Taxpayers should fill out this form when they realize that they can’t pay the taxes in full. Of course, it’s better to submit the request before the taxes due period.

What information must be provided in the FT 3567 form?

While completing the form, the requester will add the following information:

-

Personal name and SSN

-

Name and SSN of the spouse

-

Home address

-

Phone number

-

Payment amount they will pay each month

-

Date of the payment

The request must be signed and dated as well.

The Electronic Funds Transfer Authorization must contain the taxpayer’s bank name and address, bank routing number and bank account number. It should also be signed and dated.

What do I do with the form after its completion?

The completed and signed request is submitted to the Franchise Tax Board of California.